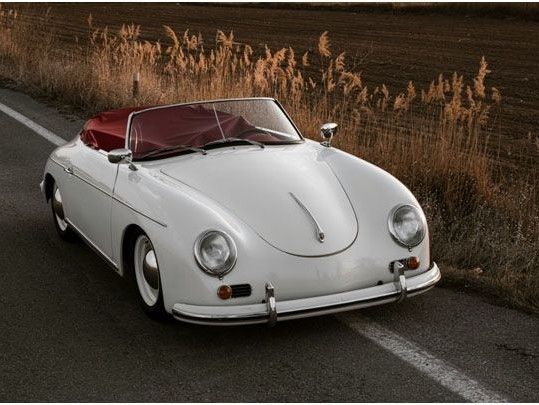

An asset that is the fasted growing of its type: Classic Cars

Wheels FCR fund initiated by Aquila (www.aquilafcr.com) and Portugal Panorama (www.portugalpanorama.com) in equal partnership takes advantage of the growing demand and popularity of Classic Cars.

Tangible: A tangible asset that has stood the test of time, exhibiting consistent growth over decades and in an efficient structure managed by an experienced team.

Consider this legacy investment an opportunity to create one for yourself and your family, steeped in a rich history. A legacy that aligns proudly with the The Portuguese Golden Visa Programme. Something that future generations will benefit from.

Investing in classic cars can be a lucrative and rewarding endeavour, supported by compelling numbers and statistics. Beyond the financial gains, classic cars offer enjoyment and pride of ownership. Additionally, with the increasing scarcity of certain vintage models due to limited production numbers and natural attrition, their value is poised to continue rising.

Secure: As seen in the past decade, the classic car market has experienced a remarkable annual growth rate of approximately 13%, significantly outperforming many traditional investment options. This is particularly true when looking at Porsche, Ferrari and Mercedes Benz valued between €150,000 and €300,000. This bracket of car retains value best and indicates the biggest vector between supply and demand. This is what the data indicates which we are able to blend with extensive experience and know how.

Classic cars have shown a high rate of appreciation and lower volatility compared to gold, art and the main market indices. Cars are goods that can be easily transferred across different countries and continents and offer a inflation and currency hedge. The global value of investment- grade cars is over €200 billion.

Percentage Price Appreciation over 10 Years *

Classic Cars: 185%

Wine: 162%

Watches: 147%

Diamonds: 116%

Art: 91%

Bags: 74%

Furniture: 35%

*according to Knight Frank as of Q4 2022

Liquid: A benefit of this kind of liquid asset is the smooth exit strategy. Classic Cars are typically sold at low cost auctions internationally where minimum prices are predetermined. There is limited risk when compared to bulkier assets looking to pull off a future IPO, family office or private equity deal.

Classic Cars allow for a phased out exit where upcycles in the market can be strategically selected to offload certain cars to maximise profits without the need of a singular large exit event that may occur at an inconvenient time.

A carefully curated and varied classic car collection helps one form an effective currency and inflation hedge. Having the ability to make informed acquisition decisions minimises the ups and downs of the general market.

Have a look at www.aquilafcr.com to know more or contact us through the website. We would welcome the opportunity to speak to you.