Understanding Diversification:

Diversification is a fundamental principle in investing that involves spreading investments across various assets to reduce risk. Traditionally, investors achieve diversification by investing in multiple funds, each representing different asset classes or sectors. The idea is that if one asset underperforms, others might compensate, thus balancing the overall portfolio performance.

However, this traditional approach can sometimes lead to over-diversification, where the investor holds so many different funds that it becomes difficult to manage and track performance effectively. Additionally, having too many funds can dilute potential gains since the standout performers are balanced out by the underperformers.

The Case for a Single Fund:

Contrary to the multi-fund approach, a single, well-structured fund can provide adequate diversification. Many modern investment funds are designed to offer broad exposure to various asset classes within one package. For example, a balanced mutual fund or a target-date fund typically includes a mix of stocks, bonds, and other securities, offering a diversified portfolio in a single investment vehicle.

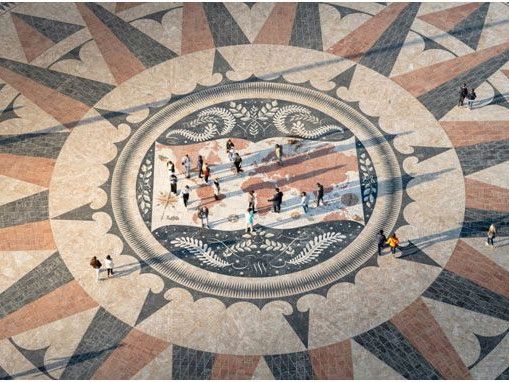

In the case of Portugal Panorama, the fund covers 4 key areas being Agriculture, Tourism, Renewable Energy and International Private Equity all in co-investment with the leading fund managers in those areas in the last 10 years.

Benefits of Co-Investment:

Cost Efficiency: Co-investment often reduces individual costs associated with management fees and transaction fees. By investing in one fund, investors can avoid the cumulative costs that come with managing multiple funds.

Simplified Management: Handling one fund is inherently simpler than managing three or more. Investors can focus on a single set of performance metrics, making it easier to track and make informed decisions.

Access to Professional Management: A single, comprehensive fund is usually managed by professional fund managers who are adept at maintaining a balanced portfolio. This expertise ensures that the fund remains diversified and aligned with the investors' goals with all investments being double checked by two independent and regulated fund managers of significant track-record.

Enhanced Diversification: Modern funds are often designed to include a wide range of asset classes and geographic regions, providing diversification that rivals a multi-fund portfolio. This allows investors to achieve broad market exposure without the need for multiple investments. This convenient and privileged access to various market leaders and investments in one source is a clear advantage and sets Portugal Panorama apart in the Golden Visa Investment Fund Space.

Practical Considerations:

When considering a single fund, it’s crucial to evaluate its structure and management.

Investors should look for funds that:

- Have a clear and transparent investment strategy.

- Offer a mix of asset classes and sectors.

- Are managed by reputable and experienced professionals.

- Have a track record of performance and stability.

Conclusion

While the traditional approach to diversification through multiple funds has its merits, the simplicity and efficiency of investing in a single, well-diversified fund cannot be overlooked.

Investors can achieve their diversification goals, enjoy cost and time benefits, and simplify their investment management. Ultimately, the adage "who needs three funds when one will do" underscores the potential advantages of a streamlined, focused investment strategy.

Contact information:

Michael Maxwell

Founder

Portugal Panorama

michael@portugalpanorama.com

+351 965 592 312

www.portugalpanorama.com

I cover 12 months with only 3 quarterly distributing ETFs. I am broadly diversified worldwide with dividend aristocrats. I even have 4 ETFs. You shouldn't put all your eggs in the same basket.

By Marcello from Porto on 01 Jul 2024, 08:31